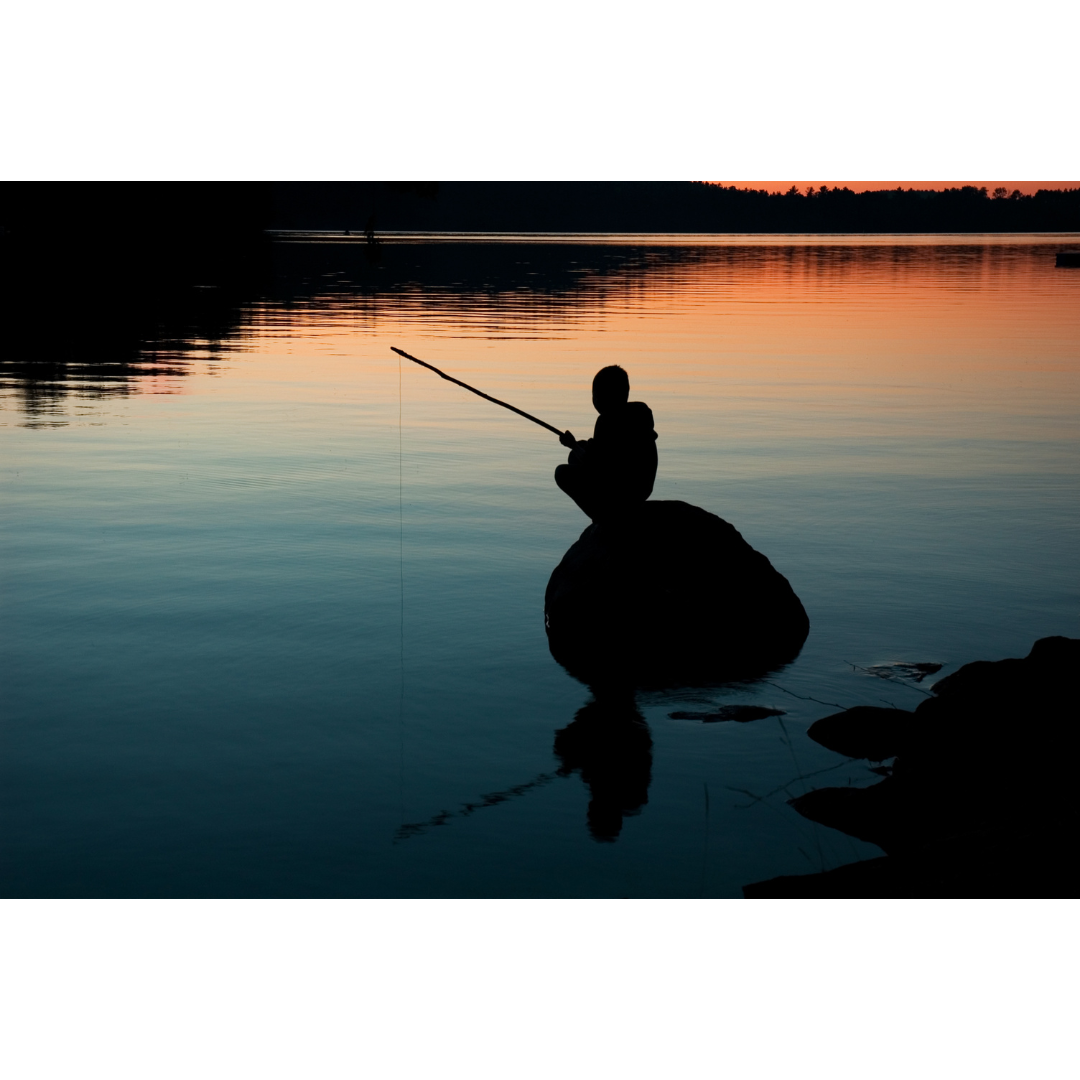

Patience is your superpower.

June 17th, 2024 [4 min. read]

By Drew W. Boyer, CFP®

Welcome to the summer grilling season.

Men everywhere wait for this moment all year to sit back, sip a cold one, and do our part cooking at least once a week.

I’m a reformed gas griller that went all-in on a smoker two Father’s Days ago. Why?

My Dad recommended it, and my little brother seconded it, but with the caveat the learning curve will make you curse the first few times. Ok, what the heck…

Sounds like a hot stock or crypto tip, right? I’ve definitely gotten a few of those from family as well but passed.

Mostly, I needed a reason to slow down, and a smoker makes you do just that. My twenty-minute grill time went up to at least an hour. The result? Pure culinary deliciousness and time well spent in my hammock. In this world of go-go-go and information overload, it pays to intentionally slow down, unplug, and keep your eyes on the bigger picture.

The same philosophy goes for investing.

Patience pays.

Patience is a superpower.

Patience is something we all have on tap.

It’s mid-2024. The stock market averages sit close to all-time highs. We had had a healthy -10% correction late last year that shook out the gamblers on fears of a weakening economy. When the economy turned out to be not as bad as feared and that Federal Reserve rate cuts were all but assured this year, we rallied to all-time highs.

Then in April, we had another normal -5% correction from fear of little to no rate cuts this year. Why? The economy is too strong. Spotting the pattern?

You can call this a bull market rally that ‘climbs a wall of worry’, but the best advice in investing is time in the markets, not timing the markets.

This bull market has been a bit different with ‘cash’ paying 4-5% instead of 0% in the previous 15 years. For some people with no investment tolerance, that’s an easy choice. T-bill and chill or CD me. So, what have I done for my clients? Absolutely nothing, but hot air.

Hot air in the form of my talking to a few of them on the phone to calm nerves and remind them that if they want to be successful in investing, they must take all emotion, politics, and geopolitical worries out of investing. To not fall prey to the never-ending dance of investors between fear and greed. It’s the same story after 20+ years of this business.

Basically, I’m a card-carrying, handholding, ‘investment therapist’. Perhaps I should update my business cards?

In his recent book, ‘Same As Ever’, Morgan Housel points out that bad things happen quickly and good things happen slowly. Just the same as (bad) news travels instantaneously and most good things go unnoticed; because it’s boring to us. There is no wow factor or attention-grabbing headline. His example of the decline of heart disease, the former #1 killer of Americans, has saved approximately 25 million lives by declining some 40% since 1950. The actual stat we see? It declines about 0.5-1.0% per year. Boring! I can’t imagine any news running that as a headline, especially during our geriatric Olympics for the presidency.

Good news of any kind tends to be so minimal, that we forget the cumulative or compounding effects- exactly the same in personal finance. Slow down, get in your hammock, stay patient, and always remember the bigger picture.

What would’ve happened to my clients if I had tried to time the markets and forgot it’s time in the markets that really matter? Better question, did my clients that wanted to cash out learn from this? Probably not, but that’s what they pay me for: advice. Sometimes it’s actionable and sometimes it’s to do absolutely nothing.

There’s a great Vanguard video chart showing ‘what if’ an investor lost their nerve, sold everything, and went to cash at the bottom of every bear market crash. It’s really simple: they lose. They sell at the lows, and they miss all the new highs, every time. That's the formula for losing.

How to win? Have a funded emergency account to smooth out the market's ups and downs. You only lose if you sell an investment when it’s down. A paper loss stays on paper till you make it real. Have cash. Use it when necessary.

My job is to remind my clients:

- Stay composed.

- Keep a fully funded, emergency savings account.

- Save regularly for a long time.

- When you hit your goals, celebrate, and then redeem funds slowly over a long time.

- Go back to work only if you get bored.

- Become self-insured.

- Money is a tool and enjoy life responsibly- whatever that definition is to you.

It’s all terribly boring and predictable. I make a point to joke in my client meetings that boring and predictable are the new luxuries in a world full of crazy. So is staying patient in investing.

Grab a cold one, put something on the grill, put your feet up, and practice the superpower of patience. It’ll all work out.